Introduction

Understanding Arizona property taxes is essential for property owners—especially landlords—in 2025. This article will focus on the specifics of Arizona taxes, particularly property taxes, including tax rates, due dates, exemptions, and the assessment process unique to the state. With changes to rental tax laws, adjustments to how assessed values are calculated, and evolving tax rate structures across the counties, landlords must stay alert to avoid miscalculations and seize every opportunity for deductions.

Whether you own personal property, a multi-family complex, or a single residential property, this guide will walk you through exactly how property taxes are calculated in Arizona, using up-to-date laws, terms like full cash value, and tools like a property tax calculator.

What Changed in 2025?

Long-Term Rental Tax Ban

As of this fiscal year, Arizona eliminated local-level rental taxes on long-term leases. This affects thousands of homeowners and landlords, especially in densely populated areas like Maricopa County and Pima County.

Because of this shift, many counties are reevaluating how much revenue comes from property tax collections, which may lead to tax increases in future budgets.

Key Property Tax Concepts

Arizona property taxes are not calculated using current market value alone. Instead, the system relies on the Limited Property Value (LPV) and applies a specific assessment ratio to determine the assessed value for tax purposes.

The total assessed and total assessed value are determined by applying the assessment ratio to the LPV for all taxable properties owned by a taxpayer. These figures are crucial in property tax calculations, as they influence the amount of tax owed, eligibility for exemptions, and the application of caps or limitations on tax rates.

Full Cash Value vs. LPV

Full cash value reflects the home’s potential selling price.

Limited property value is a capped amount used to stabilize taxes.

The assessed amount is calculated from LPV × assessment ratio (10% for residential).

Because LPV growth is limited by law, even if your market value rises sharply, your tax bill may remain stable—as long as major improvements or new construction are not involved.

The primary tax rate is capped at 1% of the property’s limited value, which helps regulate overall property tax liabilities.

Property Tax Timeline

Here’s how property taxes work across the calendar year:

January – County assessors release new LPVs and assessed values.

August – The county treasurer sends your tax bill.

October 1 – First installment is due.

March 1 – Second and final payment of the fiscal year.

Failure to pay on time may result in penalties or liens.

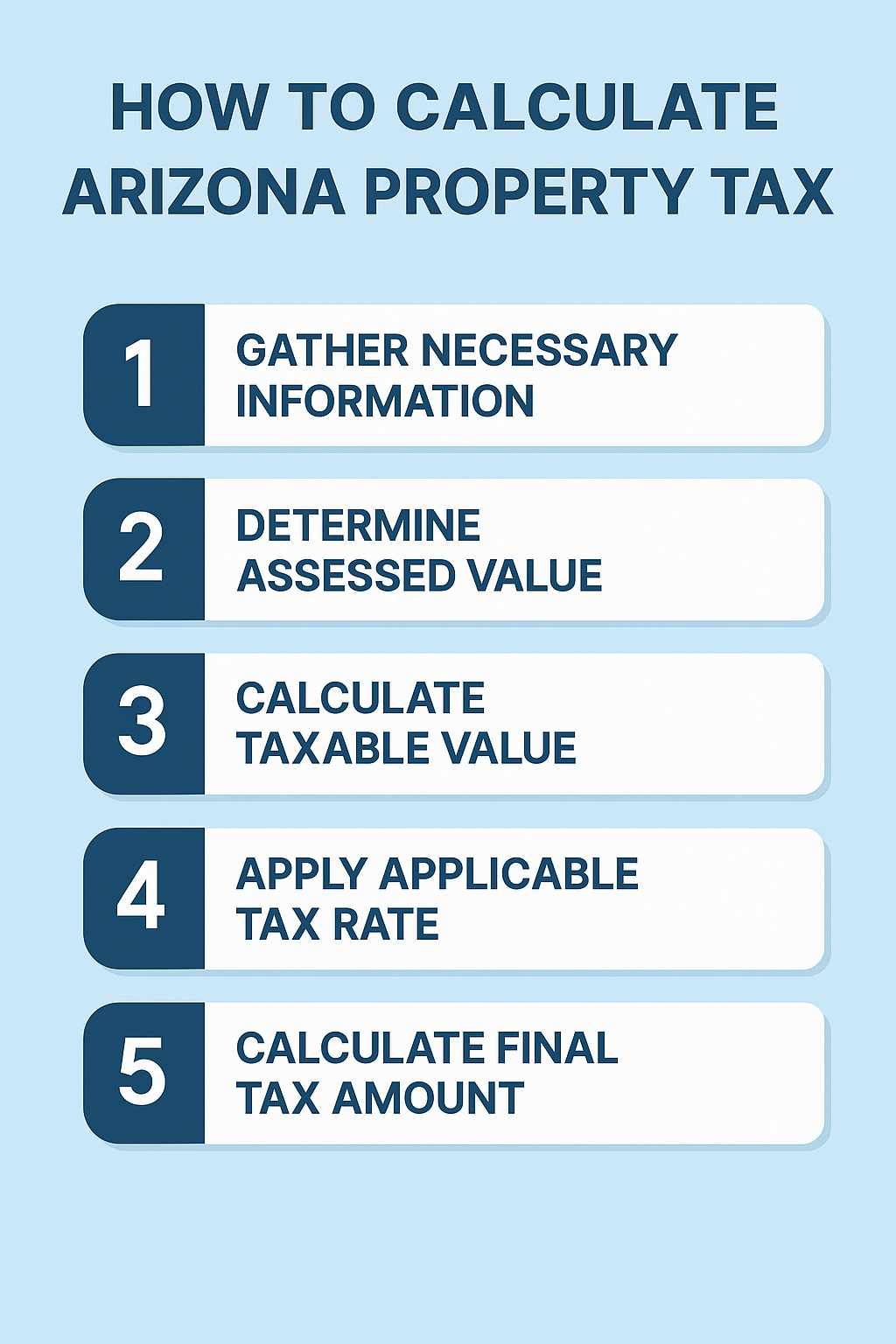

How to Calculate Property Tax

Let’s break down exactly how property taxes are calculated in Arizona.

Determine limited property value from the county.

Multiply LPV by the assessment ratio (typically 10%).

Multiply that by your total tax rate (primary + secondary + special districts). The primary tax rate is used to fund municipal and school district operations and is subject to certain calculation limits for owner-occupied homes.

Subtract any property tax exemptions.

The result is your annual tax bill.

This structure helps maintain fairness across property owners, even as property values increase.

Understanding the Tax Structure

Arizona’s property tax includes:

Primary Tax Rates

These fund essential services like schools and public safety.

Secondary Tax Rates

Used for bond issues, infrastructure, and budget overrides approved by voters.

Special Districts

Include school district taxes, flood control, fire departments, and community college districts.

Together, these components form your total tax rate.

County-Specific Considerations

Each county applies its own millage rates. For example:

Maricopa County and Pinal County often have higher tax rates.

Rural counties like La Paz County, Mohave County, and Yavapai County may offer lower taxes.

Navajo County is known for its low home values and relatively low property tax rates, resulting in lower annual tax payments for homeowners.

Cochise County and Pima County often reevaluate based on urbanization or commercial development.

It’s important to verify your jurisdiction’s rates through the Arizona Department of Revenue or the county assessor’s site.

Exemptions and Rebates

Arizona provides several property tax exemptions, such as:

Disabled individuals and veterans.

Owner occupied residences may receive special treatment. In particular, owner occupied residences receive specific rebates, such as the Homeowner Rebate of up to $600, which can reduce property tax bills and affect how tax caps are calculated.

Homeowner rebate programs apply in some cities.

Be sure to apply on time during the assessment period.

Payment and Due Dates

Arizona property taxes are paid in two installments each year, making it essential for homeowners and property owners to keep track of important deadlines. The first property tax installment is due on October 1 of the current tax year, while the second installment is due on March 1 of the following year. If either due date falls on a federal holiday, the payment deadline automatically extends to the next business day, giving you a little extra time to submit your payment.

Payments can be made by mailing a check or money order payable to your county treasurer, or by using online payment options provided by many counties. Staying on top of these due dates is crucial—missing a payment can result in late fees, penalties, or even a lien on your Arizona property. The Arizona Department of Revenue oversees property taxes statewide, but your county treasurer is the main point of contact for billing and collections.

To avoid surprises, always review your tax bill for the exact amount due and confirm the payment deadlines. If you have questions about your property taxes or need to verify your payment status, your county treasurer’s office is the best resource. Understanding how property taxes work in Arizona, including the payment schedule, helps homeowners stay compliant and avoid unnecessary costs.

Tax Administration and Billing

The administration and billing of property taxes in Arizona is handled by your county treasurer’s office, which ensures that every property owner receives a detailed tax bill each year. This tax bill outlines the total amount of property taxes due, the payment due dates, and any property tax exemptions or rebates that may apply to your property. You’ll also see a clear breakdown of the primary tax rates and secondary tax rates, including specific charges for school district taxes and special district taxes that support local services.

Your tax bill is calculated based on your property’s limited property value and full cash value, as determined by the county assessor. It’s important to review your bill carefully to make sure all eligible property tax exemptions, such as the homeowner rebate, are applied. If you qualify for any exemptions or rebates, these will be clearly listed on your statement.

Property owners in Arizona have several convenient options for paying their property taxes: online, by mail, or in person at the county treasurer’s office. Since Arizona property tax rates can vary significantly by county and even by school district, it’s wise to check your bill for the specific tax rates that apply to your property.

While the tax administration and billing process may differ slightly from one county to another, the overall system is designed to keep property owners informed and help them meet their tax obligations on time. By understanding how your property taxes are calculated and billed, you can ensure you’re paying the correct amount and taking advantage of all available benefits.

Payment and Due Dates

Arizona property taxes are paid in two installments each year, making it essential for homeowners and property owners to keep track of important deadlines. The first property tax installment is due on October 1 of the current tax year, while the second installment is due on March 1 of the following year. If either due date falls on a federal holiday, the payment deadline automatically extends to the next business day, giving you a little extra time to submit your payment.

Payments can be made by mailing a check or money order payable to your county treasurer, or by using online payment options provided by many counties. Staying on top of these due dates is crucial—missing a payment can result in late fees, penalties, or even a lien on your Arizona property. The Arizona Department of Revenue oversees property taxes statewide, but your county treasurer is the main point of contact for billing and collections.

To avoid surprises, always review your tax bill for the exact amount due and confirm the payment deadlines. If you have questions about your property taxes or need to verify your payment status, your county treasurer’s office is the best resource. Understanding how property taxes work in Arizona, including the payment schedule, helps homeowners stay compliant and avoid unnecessary costs.

Tax Administration and Billing

The administration and billing of property taxes in Arizona is handled by your county treasurer’s office, which ensures that every property owner receives a detailed tax bill each year. This tax bill outlines the total amount of property taxes due, the payment due dates, and any property tax exemptions or rebates that may apply to your property. You’ll also see a clear breakdown of the primary tax rates and secondary tax rates, including specific charges for school district taxes and special district taxes that support local services.

Your tax bill is calculated based on your property’s limited property value and full cash value, as determined by the county assessor. It’s important to review your bill carefully to make sure all eligible property tax exemptions, such as the homeowner rebate, are applied. If you qualify for any exemptions or rebates, these will be clearly listed on your statement.

Property owners in Arizona have several convenient options for paying their property taxes: online, by mail, or in person at the county treasurer’s office. Since Arizona property tax rates can vary significantly by county and even by school district, it’s wise to check your bill for the specific tax rates that apply to your property.

While the tax administration and billing process may differ slightly from one county to another, the overall system is designed to keep property owners informed and help them meet their tax obligations on time. By understanding how your property taxes are calculated and billed, you can ensure you’re paying the correct amount and taking advantage of all available benefits.

Why Your Tax Bill Might Increase

Even if your property’s limited value remains stable, your taxes may rise due to:

Local tax rate changes.

Expired exemptions.

Shifts in home values or voter-approved budget overrides.

New bond issues or school district expansions.

In many counties, residents typically pay between $1,000 and $3,000 annually in property taxes, depending on property values and local tax rates.

Average Tax Bill in Arizona

The state average effective tax rate is around 0.51%, which is below the national average. However, for the average homeowner in Arizona, actual taxes paid depend on property location, classification, and applicable exemptions.

Best Practices for Landlords

Review your assessed value annually.

Compare with similar residential properties in your area.

Appeal if you believe your valuation is inaccurate.

Claim all relevant exemptions.

Use a property tax calculator to model different scenarios.

Final Thoughts

For property owners across Arizona—from owner occupied homes to agricultural property—navigating the evolving arizona property tax rates requires more than guesswork. By learning how property taxes work, using tools, and tracking updates per county, you’ll save money and avoid surprises.

FAQs

What is a property tax exemption?

A reduction applied to your taxable value based on special qualifications like disability or veteran status.

Who sets property tax rates in Arizona?

Rates are set by cities, counties, school districts, and special districts—not the state legislature directly.

Can I appeal my property tax bill?

Yes, but you must file with your county treasurer or assessor’s office within the appeal window.

Is there a deadline for property tax payment?

Yes. The first installment is due October 1; the second is due March 1.

Does LPV apply to all property types?

It applies primarily to real property, not always to personal property or commercial assets.