Real estate investment can be a great way to make money in the long term if you have significant capital to invest on the front end. However, being successful in this field takes a great deal of focused strategy, and it’s important to choose a specific plan of action before investing in property. One of the most common methods of real estate investment is the BRRRR method, which has yielded significant returns for many investors.

What Is the BRRRR Method?

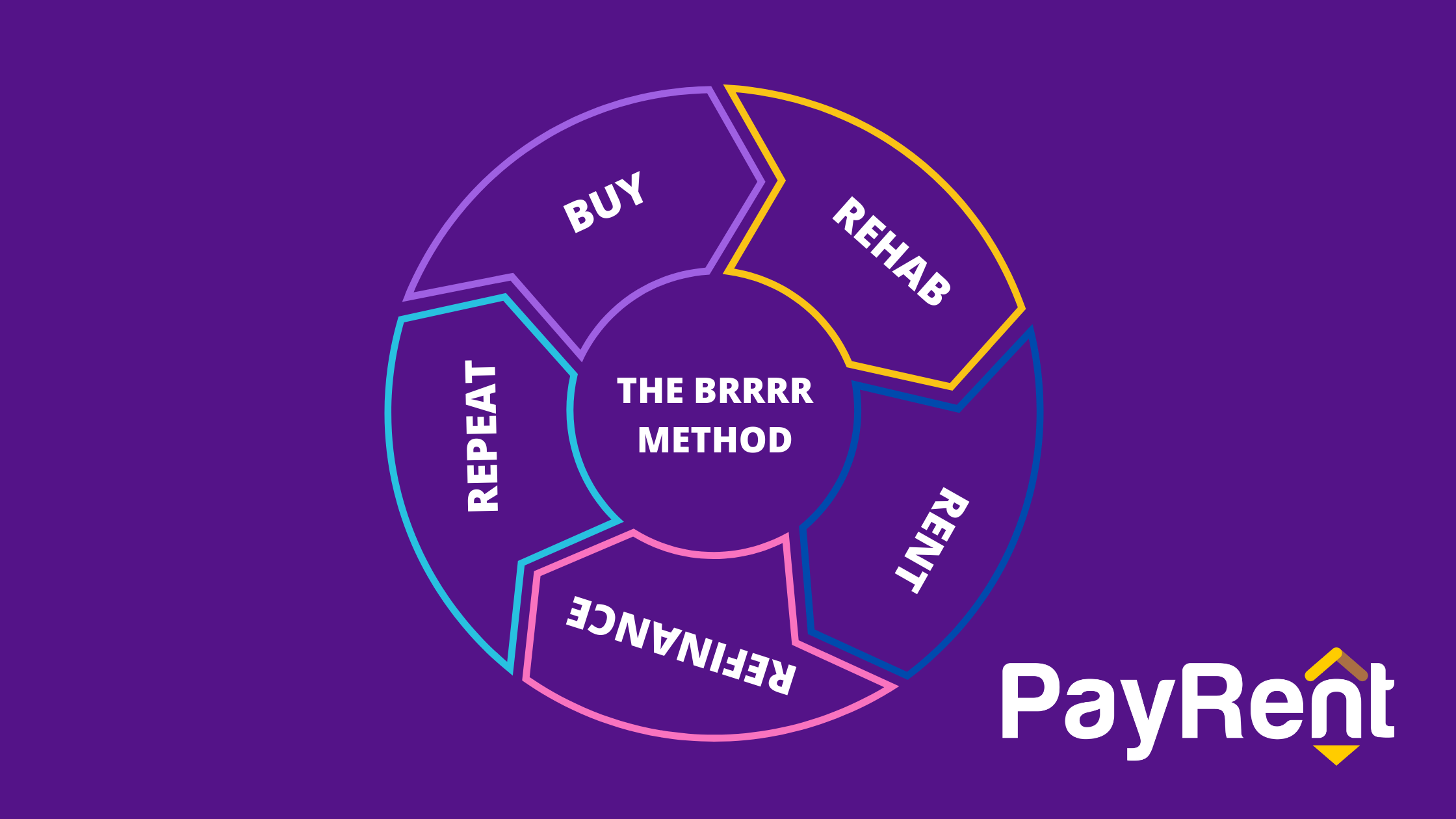

The BRRRR method is a real estate investment strategy that stands for Buy, Rehab, Rent, Refinance, and Repeat. This method focuses on investment in distressed or damaged properties and refinancing of these properties in order to purchase more real estate.

Let’s take a look at each of the steps in the BRRRR method in detail and how you can follow these steps for the highest return on your investment.

Buy

Within this strategy, you as the real estate investor will start by buying a property that needs lots of repairs and updates, which may make it difficult to access traditional mortgage options or even get a loan.

Speak to a lender to learn more about your options, which could include a hard money loan or a home equity line of credit (HELOC).

Before you purchase a property that needs fixing up, calculate its ARV, or after repair value. You can do this by comparing the final result you plan to achieve with comparable homes in the same market area. Then, try to avoid spending above 70% of the property’s projected ARV in your initial investment.

Rehab

Once you’ve purchased your property, you’ll need to begin the process of rehabilitating it with repairs and updates. In many cases, this will start with simply bringing the property up to code and making it safe to live in. Then, identify which renovations will increase the home’s value the most in terms of inside improvements as well as curb appeal.

Rent

Once your property has been properly rehabilitated, it’s time to find the right renters. This step is crucial because before you can move on to refinancing, lenders will want to see a record of tenants on the property.

As you’re screening potential renters, make sure to look for:

- Stable income

- Steady employment

- Good credit

- No history of criminal behavior or eviction

- Several reputable references

Your ideal tenants should be capable of paying whatever rental rate you’ve set. When deciding on that rate, keep in mind what’s fair to the tenants, the current market value for similar properties, and your own income.

Consider how much you’d like to bring in per month from your rental property and subtract your total owning expenses from the projected monthly rent. Play around with the numbers a bit until you come to a result that works for you and your tenants.

Refinance

After entering into a rental agreement with your new tenants, the next step in the BRRRR method is to refinance the property with a lender using a cash-out refinance agreement.

Each lender has its own requirements, but you’ll generally need to meet a certain credit score as well as a maximum debt-to-income ratio. You’ll likely also need equity in the home and a record of property ownership for a certain amount of time.

Repeat

Once you secure your cash-out refinance, you can use those funds to purchase another property in need of serious repair and repeat the process. Make sure to take note of any steps that you could have done better or differently to make the BRRRR method work more smoothly and successfully in the future.

Does the BRRRR Method Work?

The BRRRR method has several significant costs attached to it, including property purchase and home rehabilitation, which could extend well into the tens of thousands of dollars, depending on the state of the property.

Additionally, patience is an important part of this method, as renovations can take several weeks or even months to complete before your property is ready for tenants.

However, when done correctly, the BRRRR method can bring in substantial passive income, especially if you can successfully complete this method with multiple properties. You’ll also be able to boost your portfolio of rentals and build equity.