Some landlords come into ownership of their property through inheritance, and some landlords purchase properties with the intention of renting or leasing them out. However you became a landlord, getting as much return as possible on your investment is likely your chief goal.

If you have a tenant who isn’t meeting their contractual agreement in some way, it’s important that you step in and take action to protect yourself as well as your property. If the issue can’t be resolved and your tenant continues to break the contract, you’re losing money—whether it’s rent money they owe you or damage to the property that you’ll have to repair.

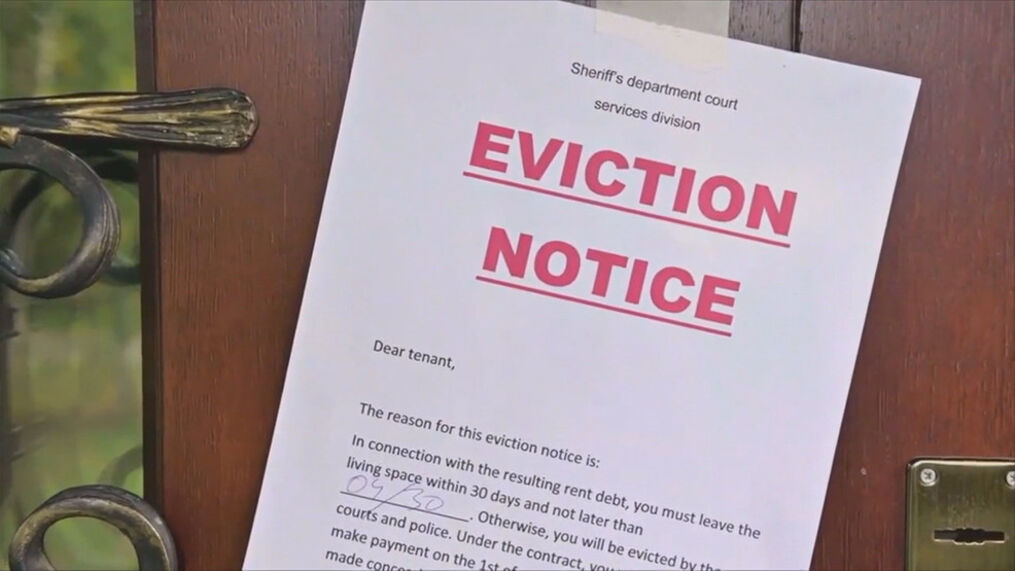

In this case, you may begin to consider eviction to recoup your costs and prepare your property for a better tenant. Before you consider eviction, it’s important to understand the laws around the process, common mistakes you can make, and what the true cost of eviction is for landlords. Though eviction can be the best financial choice for landlords if a serious tenant issue arises, the process itself requires some investment to carry out.

Legally Sound Reasons to Evict

Landlords have certain rights around the eviction of tenants, as well as several limits. Some of the legally upheld reasons for eviction include:

- The tenant misses multiple, continuous rent payments

- The tenant violates the lease or rental agreement

- The property is currently being renovated

- The property is currently for sale

- The tenant has inflicted serious damage to the property

- The tenant refuses to leave after their move-out date

Because of the costs associated with an eviction and the hassle of getting legal representatives involved, most landlords avoid eviction as long as possible. However, if you find that an eviction becomes unavoidable, it’s important to follow all local and state laws closely to avoid even more legal trouble in addition to the eviction.

Common Eviction Mistakes

The biggest mistake that landlords make when evicting a noncompliant tenant is trying to carry out the eviction themselves. This could include changing locks without ample notice or legal right, physically moving the tenant’s belongings to another location, or engaging in harassment to encourage the tenant to leave.

If you fail to give your tenant their proper due notice to vacate the property or don’t have enough evidence to support your eviction claim, you could face legal trouble for attempting to evict them.

Legal troubles could also arise if your reasons for eviction are found to be discriminatory, or if your tenant is late on rent, it is found to be unpaid for a valid reason.

What Is Included in the True Cost of Eviction?

Now that you know more about why landlords may choose to evict and what types of mistakes happen during the eviction process, you might be wondering what expenses are included in the true cost of eviction.

The legal process generally starts at around $550 for eviction attorney fees and fees associated with court filings.

If you’re citing unpaid rent as a reason for tenant eviction, you’ll have to factor the lost rent into the true cost of eviction. Depending on your rent rates and how many payments the tenant missed, the lost rent might add up to around $2,000.

Changing the locks with a professional locksmith can cost around $150, and the costs associated with property turnover, including mortgage expenses, property management payments, costs of advertising, cleaning service fees, and maintenance costs could total at least $2,000.

With all of these average costs combined, the true cost of eviction could add up to at least $4,700, and likely more, depending on your property and situation. In addition, you must consider all of the time you’ll have to spend carrying out the eviction process, finding a responsible new tenant, and the stress it will cause you.

How Can I Avoid an Eviction?

One common method for avoiding eviction is the “cash for keys” approach. Most landlords and tenants want to avoid legal intervention as much as possible, and in a “cash for keys” agreement, landlords can offer a payout to disruptive tenants to have them leave the property without going through the official, probably more expensive, eviction process.